Mar 01 2021

Bitcoin’s Achilles Heel

We are approaching 8 billion people on this planet, and so anything that a lot of people do is likely to have a significant impact. This includes things that we previously considered to be essentially resource free, or at least insignificant, including digital activity. This may be a bit of a generational thing – those of us who lived through the explosion of computer use, the adoption of the web and social media, and the general shift from analog to digital technology grew up with the idea that doing things digitally was resource efficient.

We are approaching 8 billion people on this planet, and so anything that a lot of people do is likely to have a significant impact. This includes things that we previously considered to be essentially resource free, or at least insignificant, including digital activity. This may be a bit of a generational thing – those of us who lived through the explosion of computer use, the adoption of the web and social media, and the general shift from analog to digital technology grew up with the idea that doing things digitally was resource efficient.

For example, there was a huge push to transform to a “paperless office” because that would save trees. It is much better to shuffle electrons around than pieces of paper. This transition took a lot longer than anyone thought, and in fact – it hasn’t really happened yet. Here we are, 40 years later, and office paper use is still increasing. No one would have predicted that.

Because of the pandemic meetings and many services shifted from in-person to online, over Zoom, for example. This is much more efficient than people traveling to the same physical location for the meeting. But this does not mean we can ignore the electricity use, and therefore carbon footprint, of the digital meeting. A recent study, for example, found that simply turning off the video when not needed can reduce that footprint by 96%. This is small individually, but huge in the aggregate:

Turning off a camera for 15 hour-long meetings every week would reduce carbon dioxide emissions by 9.4 kilograms (20.7 pounds) per month. If one million Zoom users did this, they would save 9,000 tons of CO2, the equivalent of coal-powered energy used by a city of 36,000 in that same month.

We are now streaming movies instead of driving to a Blockbuster. Again, this is good, but streaming increasingly high resolution movies has a significant carbon footprint too. Further, people tend to increase their resource use when that resource becomes cheaper and more efficient, making up for the higher efficiency. Lighting is a great example of this – as lights become more energy efficient, we simply are using more lighting. This is called the “energy efficiency paradox” – we are actually using more electricity for lighting as it becomes more efficient. (There is a completely tangential side problem of light pollution and observing the night-time sky, but that is a separate post for another day.)

This brings me to Bitcoin, the most famous cryptocurrency. This is a purely electronic version of money, and so again we are just crunching numbers in a computer rather than moving around anything physical. The difference between cryptocurrency and your electronic bank statement is that the former has not physical existence anywhere. Cryptocurrency only exists as a software phenomenon. Further, the computer code that manages cryptocurrency, called blockchain, is designed for security and anonymity. It is designed not to be hackable – since Bitcoin emerged in 2009 the system has not been hacked. However, individual electronic wallets have been hacked.

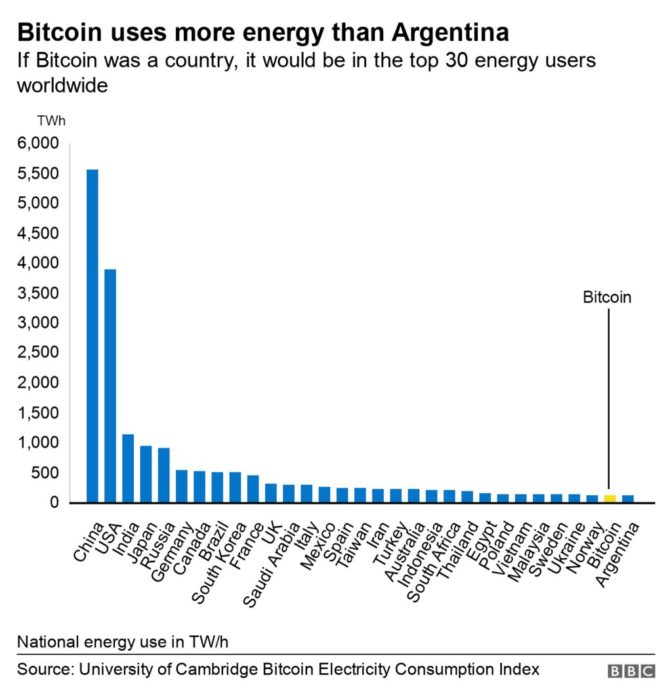

The main problem with Bitcoin is likely that it is massively resource intensive. It takes a lot of computing power to mine Bitcoin and to mange the distributed system. How much? Recently The University of Cambridge Centre for Alternative Finance (CCAF) studies estimated the energy use of Bitcoin:

It calculates that Bitcoin’s total energy consumption is somewhere between 40 and 445 annualised terawatt hours (TWh), with a central estimate of about 130 terawatt hours.

For comparison, all datacenters around the world use 199 TWh. The UK uses about 300 TWh per year – not just for computing, for everything. Bitcoin uses more energy than entire countries. Further, the CCAF team estimated that two-thirds of that energy comes from burning fossil fuel.

Further, Bitcoin is designed not to be scalable. The quick version is that new Bitcoin are created by miners, who use computer power to guess random numbers and winners are rewarded with Bitcoin. They also independently verify Bitcoin transactions, so they are core to its operation. This is extremely resource intensive. But worse – as more people use Bitcoin and as the price goes up, the incentive for mining goes up. The more miners there are, the more difficult the random number puzzles become to compensate, and therefore the more computing power each miner needs to compete. By one estimate, if Bitcoin became the world’s sole currency, we would need to double our worldwide energy production. This doesn’t include building and maintaining all that computing power.

I think it’s safe to say that cryptocurrency, as currently managed, will not become the de-facto currency anytime soon. I don’t know if there is a solution to this inherent problem, or if it means blockchain is inherently an unscalable application. For now, Bitcoin will remain niche. But even then, it is consuming the energy of a medium-sized country.

As we are now fully in the digital age, we need to consider the efficiency of the most common digital applications. This has to include the “efficiency paradox” about how convenience and low cost drives increased use. We cannot assume that the energy use of our computers is negligible. They are an increasing portion of our total energy use.